Most IMOs will teach you how to sell. They’ll show you how to close, handle objections, and maybe even how to recruit. But very few will sit you down and teach you how to run your business like… a business.

And here’s the truth: without the right systems in place, every time something goes wrong—commissions get delayed, a big chargeback hits, or leads slow down—you feel the bottom fall out from under you. That anxiety is what drives too many good agents out of this industry.

The good news? You don’t need to be a CPA or an MBA to run a sustainable business. What you do need is a simple, repeatable system that smooths out the bumps. Let me walk you through the systems I’ve seen separate the agents who thrive from the agents who burn out.

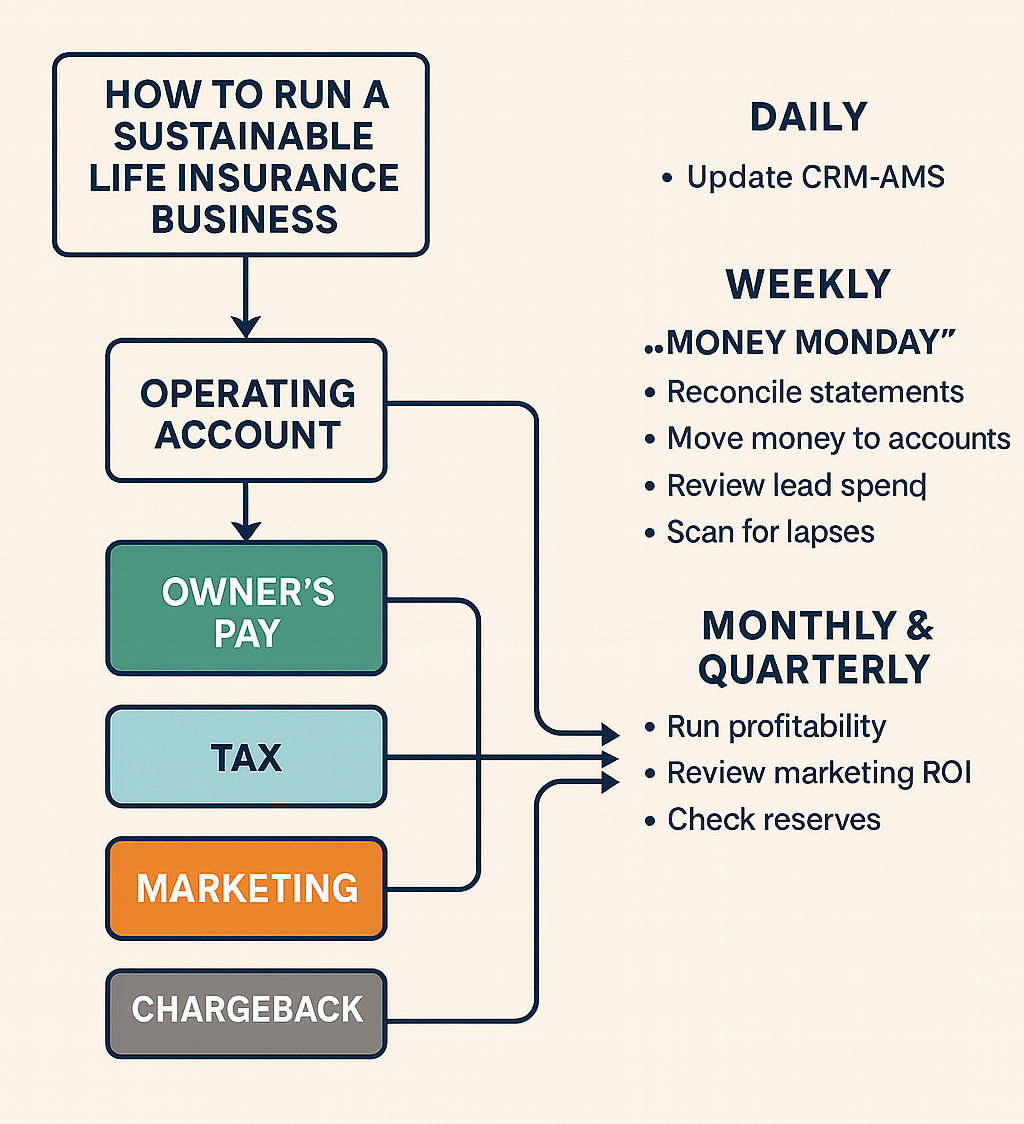

The Foundation: Separate Your Money Into Accounts

Don’t keep everything in one account. That’s chaos waiting to happen. Instead, set up multiple accounts to give every dollar a job. At a minimum, you want:

- Operating – covers your business expenses and overhead.

- Owner’s Pay – this is how you pay yourself.

- Marketing – keeps your lead flow consistent.

- Chargeback Reserve – a safety net when a client cancels.

Now, if you don’t use a payroll company, you’ll also want a Tax account. That way, you’re setting aside money for quarterly taxes and never scrambling in April.

But here’s the smarter option: use an online payroll service that supports sole proprietors. They’ll handle withholding and paying your taxes automatically, so you can skip the Tax account altogether. It’s a small monthly fee that saves you time, stress, and those big ugly quarterly tax bills. Your paycheck then shows up in your personal account like clockwork—just like a W-2 job.

Don’t Treat Advances Like They’re Yours (Yet)

Advances are one of the biggest traps for new agents. The carrier gives you 75% up front, and it feels like a big paycheck—but remember, that’s just an advance. If the client cancels, that money gets clawed back.

Here’s what sustainable agents do:

- Track commissions weekly, noting advances, as-earned schedules, and clawback windows.

- Pay themselves from a 3–4 week rolling average of net commissions.

That way, one hot week doesn’t trick you into overspending, and one bad week doesn’t send you into panic mode.

Budget for Chargebacks (Because They’re Coming)

Chargebacks are not a sign you’re failing—they’re a sign you’re in the business. The difference between agents who survive and agents who fold is whether they plan for them.

Every week, move money into your Chargeback Reserve. Then, when a clawback hits, you don’t scramble—you just transfer from the reserve.

You can also reduce chargebacks with a few simple habits:

- Call every client within 48 hours of issue to welcome them.

- Check in at 30 days.

- Audit payment methods—auto-draft beats paper billing every time.

A little prevention goes a long way.

Pay Yourself the Smart Way

Here’s a simple starting point for allocating your net commissions:

- Owner’s Pay – 30%

- Taxes – 25% (skip this if you’re on payroll)

- Marketing – 15%

- Operating – 15%

- Chargeback Reserve – 10%

- Buffer – 5%

As you stabilize and your persistency improves, you can bump Owner’s Pay up a bit.

The real key here is predictability. With payroll, you set your own “salary floor” and then pay yourself quarterly bonuses if your rolling average allows. That steadiness kills 90% of the anxiety in this business.

Always Fund Marketing (Even on Bad Weeks)

Marketing is oxygen. When times are tough, the worst mistake you can make is cutting lead flow. That’s how agents spiral out.

Decide on a weekly marketing budget as a percentage of your net commissions, and stick to it—rain or shine.

A good split looks like this:

- 70% proven channels

- 20% testing new sources

- 10% long-term branding (relationships, community, centers of influence)

This balance keeps your funnel alive without chasing shiny objects.

Daily, Weekly, Monthly: Your Business Rhythm

The agents who thrive treat their business like a business. That means daily habits, a weekly rhythm, and a monthly/quarterly review. Let’s break it down:

Daily – The 15-Minute Discipline

Every night, update your CRM-AMS:

- Add new leads, clients, policies, recruits, and agents.

- Update status changes (set, sat, sold, pending, issued, charged back).

This takes 10–15 minutes but keeps your business visible and under control. You can’t fix what you don’t track.

Weekly – “Money Monday” (90 minutes)

Block out time every Monday to:

- Reconcile your carrier statements.

- Move money into your accounts.

- Review lead spend and appointments for the coming week.

- Scan for upcoming chargebacks or lapses.

Same time, same day, same process. Do this, and you’ll save yourself a hundred little panics.

Monthly & Quarterly – The Big Picture

At the end of every month:

- Run profitability by product/carrier.

- Review marketing ROI.

- Check how many weeks of expenses your reserves cover.

At the end of every quarter:

- Verify your tax set-aside or payroll withholdings.

- Adjust allocation percentages if needed.

- Refresh your annual goals and budgets.

These rhythms keep you in control instead of reactive.

What To Do When Trouble Hits

Every business hits bumps. The key is knowing what to do when—not reacting emotionally.

Here’s your stabilization plan:

- Cut non-essentials first (subscriptions, perks).

- Protect lead flow—never starve your pipeline.

- Check your runway—how many weeks of expenses your reserves cover.

- Pull the three levers: increase activity, focus on larger cases, conserve inforce policies.

Do this, and you’ll outlast 90% of the noise.

Final Word

Here’s the truth: selling life insurance can make you wealthy, but running your insurance business like a business is what makes you sustainable.

If you set up multiple accounts, automate your payroll and taxes, update your CRM-AMS daily, and follow your weekly and monthly rhythms, you’ll never again wonder where the money went or why the stress is eating you alive.

Build the system now, and you’ll have a foundation strong enough to weather any storm. That’s how you get peace of mind—and sleep at night.